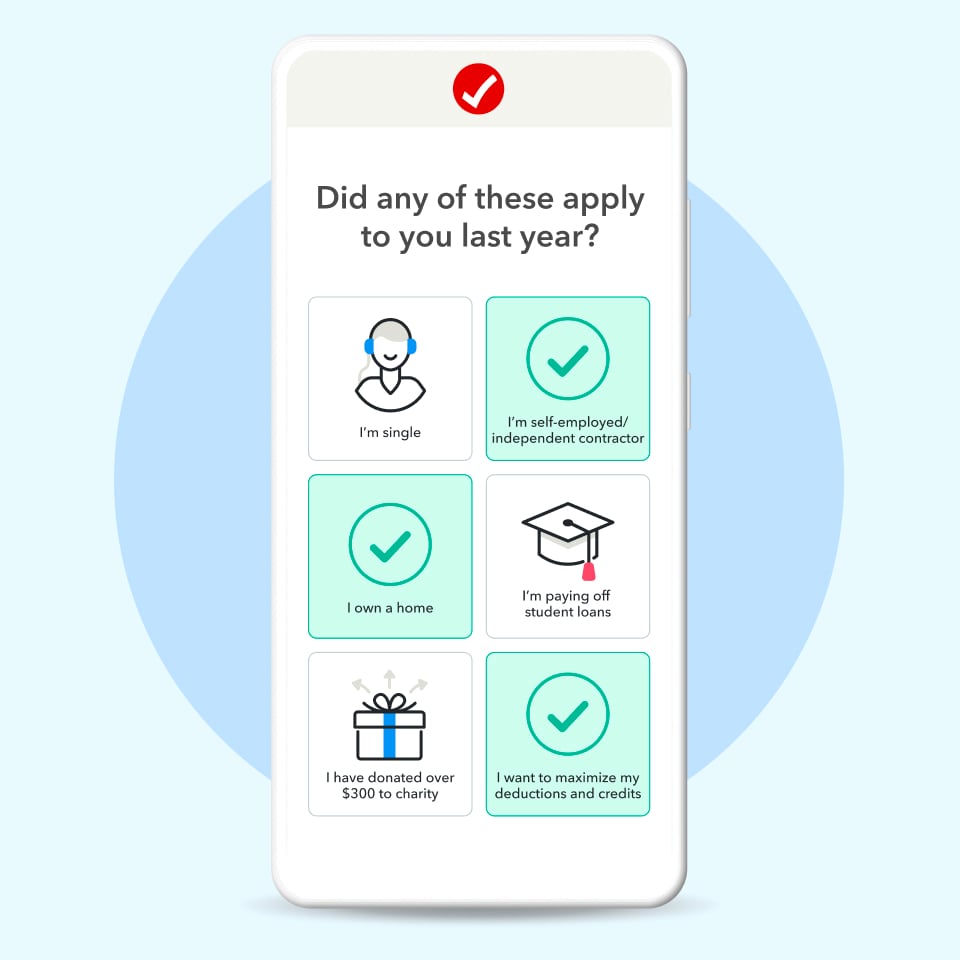

We use general info such as your filling status, number of dependents, and taxable income to get an understanding of your

tax situation.

Do you own a home, have student loans, give donations, or any other itemized deductions? We use this information in our tax return calculator to give you an accurate estimate of

your return.

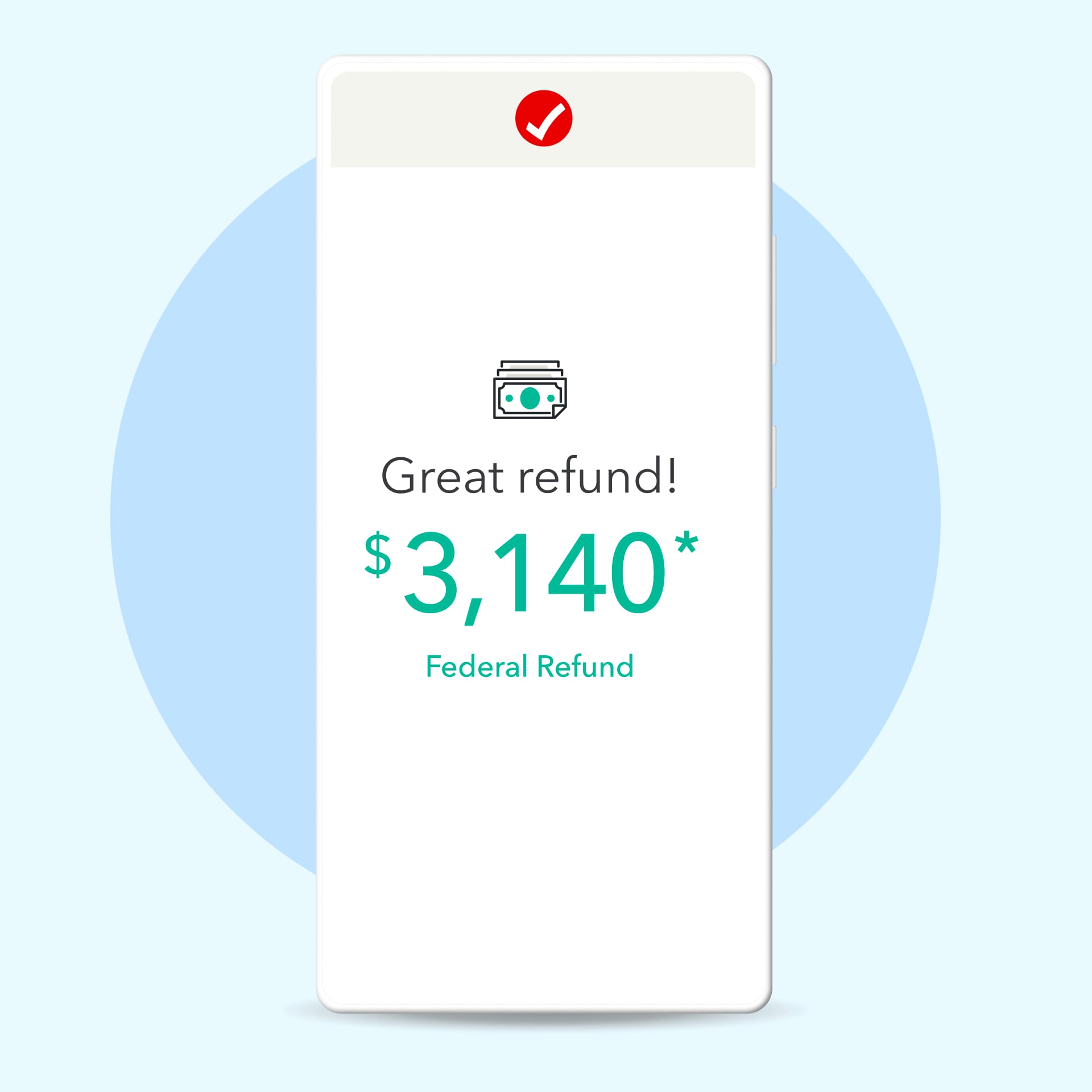

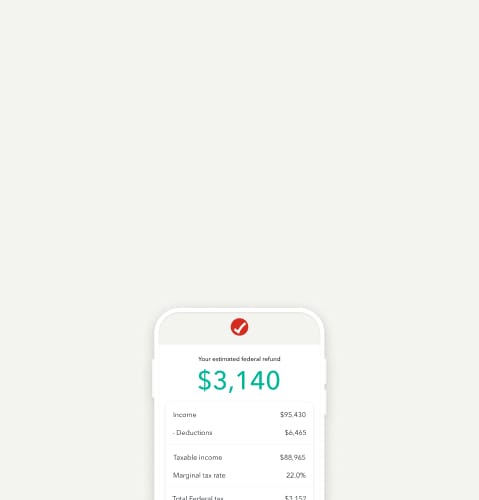

Based on your info, our tax refund estimator calculates your tax return, or amount owed for this tax year. Use this to get a head start understanding

your taxes.

Enter some simple questions about your situation, and TaxCaster will estimate your tax refund amount, or how much you may owe to the IRS. TaxCaster stays up to date with the latest tax laws, so you can be confident the calculations are current. The results are only estimates however, as various other factors can impact your tax outcome in the income tax calculator. When you file with TurboTax, we’ll guide you step by step to ensure your taxes are done accurately.

The tax calculator estimates that I owe money. How do I lower the amount?The simplest way to lower the amount you owe is to adjust your tax withholdings on your W-4. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

Your tax bracket is determined by your taxable income and filing status. Knowing your tax bracket can help you make smarter financial decisions. Use our Tax Bracket Calculator to determine your bracket.

What’s the difference between standard and itemized deductions?The standard deduction is a set amount based on your filing status. Itemized deductions are ones you can claim based on your yearly expenses. It makes sense to choose whichever will yield you the greatest tax break, but if you choose to itemize deductions, you’ll need to keep track of your expenses and have receipts or documentation ready.

Why should you estimate your tax refund?Estimating your tax refund can help you prepare for tax season. By using a tax refund calculator, you'll get an idea of how much you might get back or owe. This can help you plan your finances better, whether it's setting aside money if you owe taxes or planning how to use a potential refund. Remember, it's just an estimate, but it can give you a good starting point.

What should I do after getting a tax return estimate?After getting a 2023 tax return estimate using the TaxCaster tax estimator for the 2024 tax filing season, it's time to plan. If you're expecting a refund, consider how you can use it wisely. Maybe it's time to boost your emergency fund, pay down debt, or invest in your future. If you owe taxes, start budgeting now to cover that upcoming expense. You can also look at ways to potentially increase your refund, like checking if you've taken advantage of all eligible tax deductions and credits. Remember, the TaxCaster tax estimator gives you an insight into your tax situation.

This TurboTax calculator is one of many tools that you can use to plan ahead for tax season. See all of our tax tools here.

Can the tax refund calculator be used for state taxes?The TaxCaster calculator is designed for estimating federal taxes. Federal and state taxes are different, with federal taxes covering nationwide programs and services, while state taxes fund state-specific needs. However, while the calculator focuses on federal taxes, TurboTax can help you with both federal and state taxes. Our tools are designed to consider the specific tax laws and provisions of each state, helping you accurately prepare both your state and federal taxes.

How do I pay if I owe taxes?If you've followed all the recommendations to lower your tax liability and still owe taxes, don't worry. TurboTax offers several ways to pay, including direct debit from a bank account and mail-in payments. If you can't pay the full amount right away, the IRS offers payment plans and installment agreements. Remember, even if you file for an extension, any payment you owe is still due by the April deadline.

What documents do you need to complete the tax refund calculator?Keep in mind, you don’t need to wait to have your final documents in-hand to use the calculator. You can use a pay stub instead. But having the actual documents will make the results more accurate.

Estimate your tax refund and see where you stand

Easily calculate your tax

rate to

make smart

financial decisions

Know how much to withhold from your

paycheck to get

a bigger refund

Estimate your self-employment tax and

eliminate

any surprises

Estimate capital gains, losses, and taxes for

cryptocurrency sales

Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

See how much

your charitable donations are worth

Download the TaxCaster Tax Calculator App to your Android

or iPhone. We save your information — change it anytime and

our tax calculator will show you how it affects your federal

tax refund.

See how life events like getting married, going back to school, or having a child can change your tax refund.

Anticipating a tax refund after using our tax refund estimator? Set yourself up for the future by making smart

money decisions.

When you file your taxes, your adjusted gross income (AGI) can impact your eligibility for deductions and credits that can boost your tax refund.

Tax credits can reduce how much income tax you owe, and can add to your tax refund. However, tax credits come with requirements you must satisfy before claiming them.

Learn more about the changes to tax benefits and adjustments that may have impacted your original estimate for your tax refund.

Learn more about the changes to tax benefits and adjustments that may have impacted your original estimate for your tax refund.

Review the federal tax rate schedules and tax bracket calculator to help you estimate your refund.

The W-4 determines how much is withheld from your paycheck. Use this guide to make sure you're filling it out correctly.

These tips can help you lower your effective tax rate and your tax bill.

See how our customers rate TurboTax

( 4.7 / 5 | 29240 reviews)Learn how to check your refund status and track your refund so you know when to expect it.

File faster and easier with the free TurboTax app

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible.

If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

Situations not covered:

TurboTax Individual Returns:

TurboTax Business Returns:

For Credit Karma Money (checking account): Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

Fees: Third-party fees may apply. Please see Credit Karma Money Account Terms & Disclosures for more information.